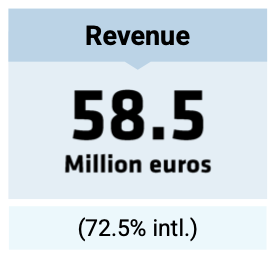

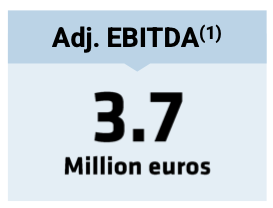

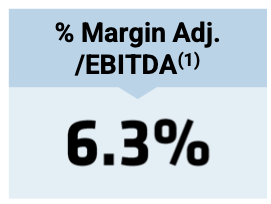

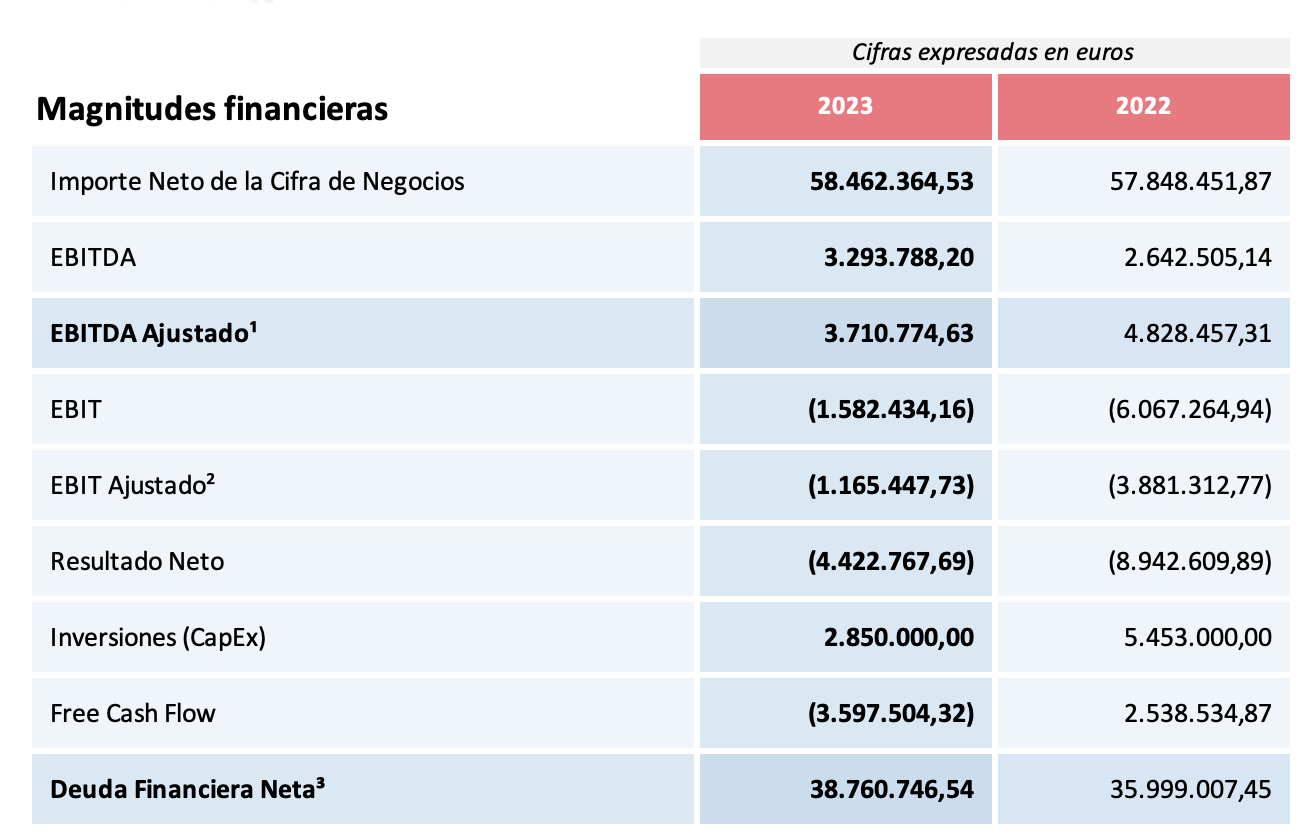

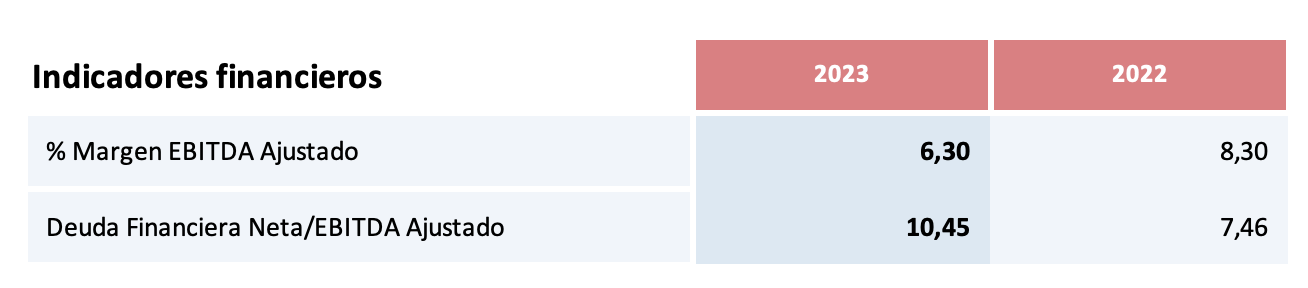

Key Financial and Operational Figures

1.Adjusted EBITDA as profit before interest, taxes, depreciation, and amortization, deducting extraordinary expenses arising from the increase in material costs due to inflation caused by international conflicts and rising energy and raw material prices; the IPO process; the VTZ/LSEE merger; the failure to acquire Laboratorios Ovejero, as well as the cost impact caused by the depreciation of the Turkish lira on the gross margin (sales and cost of sales) in our Turkey subsidiary in 2022. For 2023, this includes expenses related to the Miralta & Blantyre process and the search for advisors (advisors for the entire process).

2.Net Financial Debt as of 31.12.2023.

1.Adjusted EBITDA as profit before interest, taxes, depreciation, and amortization, deducting extraordinary expenses arising from the increase in material costs due to inflation caused by international conflicts and rising energy and raw material prices; the IPO process; the VTZ/LSEE merger; the failure to acquire Laboratorios Ovejero, as well as the cost impact caused by the depreciation of the Turkish lira on the gross margin (sales and cost of sales) in our Turkey subsidiary in 2022. For 2023, this includes expenses related to the Miralta & Blantyre process and the search for advisors (advisors for the entire process).2.Adjusted EBIT as profit before interest and taxes, deducting extraordinary expenses arising from the increase in material costs due to inflation caused by international conflicts and rising energy and raw material prices; the IPO process; the VTZ/LSEE merger; the failure to acquire Laboratorios Ovejero, as well as the cost impact caused by the depreciation of the Turkish lira on the gross margin (sales and cost of sales) in our Turkey subsidiary in 2022. For 2023, this includes expenses related to the Miralta & Blantyre process and the search for advisors (advisors for the entire process).3.Net Financial Debt as of 31.12.2023 and 31.12.2022.

Table of Key Figures

23 KB

Contact

Avenida Europa, 34 1ºD

28023 Pozuelo de Alarcón (Madrid)

Phone: (+34) 91 991 26 28